Running a business in Singapore, particularly a small to medium-sized private limited company, comes with its own set of challenges and opportunities. One of the critical aspects of maintaining a business’s financial health is avoiding negative equity. But what exactly does Negative Equity in Private Limited Company Singapore mean, and how can you prevent it?

In this article, ACHI Biz explores the concept of negative equity, why it’s significant, and practical steps you can take to steer clear of it. We’ll also touch on the implications for limited company debt and overall business financial health. Let’s dive in.

Understanding Negative Equity

Negative equity occurs when a company’s liabilities exceed its assets. Essentially, it means that the business owes more than it owns. This situation can be detrimental, affecting the company’s ability to borrow money, attract investors, and can even lead to insolvency if not addressed promptly.

Why Negative Equity Matters

Having negative equity can signal poor financial management or unforeseen circumstances that have led to financial strain. It can impact your business’s reputation and limit your options for growth or expansion. Therefore, understanding and preventing negative equity is crucial for any business owner in Singapore.

Steps to Avoid Negative Equity

1. Maintain Accurate Financial Records

Keeping precise and up-to-date financial records is the foundation of avoiding negative equity. Regularly monitor your assets and liabilities to ensure you have a clear picture of your company’s financial standing.

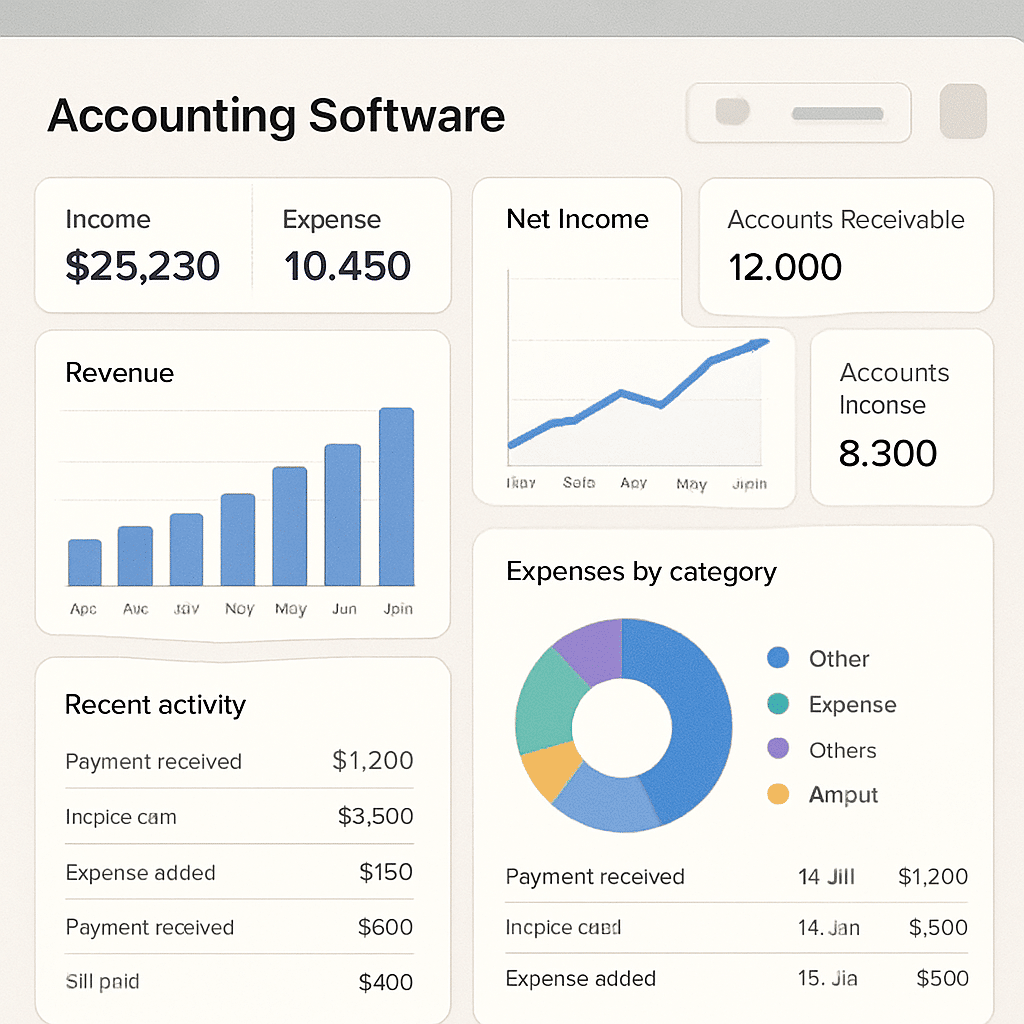

Use Accounting Software: Invest in reliable accounting software that can help track your financial data efficiently.

Regular Audits: Conduct regular audits to catch discrepancies early and address them promptly.

2. Manage Limited Company Debt Wisely

Debt is often a necessary part of business operations, but managing it wisely is essential to prevent negative equity.

- Avoid Overborrowing: Only borrow what you need and can afford to repay.

- Negotiate Terms: Work with lenders to negotiate favorable repayment terms that align with your cash flow.

3. Increase Revenue Streams

Diversifying your revenue streams can provide a buffer against financial downturns and help maintain positive equity.

- Explore New Markets: Look for opportunities to expand your product or service offerings to new markets.

- Innovate: Continuously seek innovative ways to meet customer needs and stand out from competitors.

4. Control Operational Costs

Monitoring and controlling your operational costs is another critical step in avoiding negative equity.

- Budgeting: Create detailed budgets that account for all expenses and stick to them.

- Cost-Cutting: Identify areas where you can reduce costs without compromising quality.

Financial Health Check for Your Business

Regular financial health checks can help ensure your business is on the right track and that you’re avoiding negative equity. ACHI Biz recommends regular reviews and professional guidance for long-term stability.

Conduct Financial Analysis

Perform regular financial analyses to assess your company’s performance. This includes reviewing financial statements and key metrics like profit margins, liquidity ratios, and debt-to-equity ratios.

Seek Professional Advice

Don’t hesitate to seek advice from financial experts or corporate service providers like ACHI Biz, who can provide insights and recommendations tailored to your business’s unique situation.

Plan for the Future

Develop a strategic financial plan that includes both short-term and long-term goals. Planning for the future ensures that you have a roadmap for maintaining financial health and avoiding negative equity.

Implications of Negative Equity

If your business does fall into negative equity, it’s important to understand the implications and take immediate action.

Impact on Borrowing

Negative equity can make it challenging to secure additional funding, as lenders may view your business as high-risk.

Investor Confidence

Investors may be hesitant to invest in a company with negative equity, as it suggests financial instability.

Risk of Insolvency

In severe cases, prolonged negative equity can lead to insolvency, where your company is unable to meet its financial obligations.

Conclusion

Avoiding negative equity in a private limited company in Singapore is crucial for the sustainability and growth of a small to medium-sized business.

By maintaining accurate financial records, managing debt wisely, increasing revenue streams, and controlling operational costs, you can protect your business from financial distress.

Regular financial health checks and professional advice from ACHI Biz can further safeguard your company against the risks of negative equity. By taking proactive steps, you ensure the long-term success and stability of your business.

24/7/365

24/7/365