Achi Biz GuidesOffshore: Anguilla

Guide For Offshore Corporate Services In Anguilla

Guide For Offshore Corporate Services In Anguilla

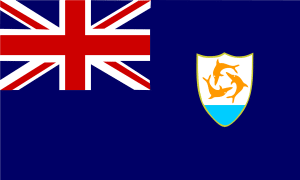

Anguilla is a part of the Britain Overseas Territory. Anguilla, the most northerly of the Caribbean Leeward Islands, has a landmass of 90 sq. km. The British established control of Anguilla in the late 1600’s, prevailing in numerous skirmishes with other European powers throughout the colonial period, so that today Anguilla is a British Dependent Territory.

Anguilla is located approximately one and a half hours south east of Miami, Florida, or four and a half hours south east of New York City. There are flight connections to Anguilla from those and other United States cities, as well as from Europe and Latin America, through Puerto Rico, St. Maarten, Antigua, and Curacao.

Infrastructure

Communications facilities on Anguilla are exceptional and expanding. International direct dial, cellular connections, fax, modem, Internet, and dedicated e-mail service lines are all available.

Economy

Anguilla has few natural resources, and the economy depends heavily on luxury tourism, offshore banking, lobster fishing, and remittances from emigrants. Increased activity in the tourism industry has spurred the growth of the construction sector contributing to economic growth. Anguillan officials have put substantial effort into developing the offshore financial sector, which is small but growing. In the medium term, prospects for the economy will depend largely on the tourism sector and, therefore, on revived income growth in the industrialized nations as well as on favourable weather conditions.

Type of Law

Anguilla, most northerly of the Leeward Islands, is an overseas dependent territory of the British government. The head of state is H.M. Queen Elizabeth II, represented locally by an appointed governor. The government has three branches: legislative, executive, and judicial. Its common law legal system is based on the English model. The Eastern Caribbean States Supreme Court is the principal judicial body.

Central Bank

The Eastern Caribbean Central Bank (ECCB) is Anguilla’s monetary authority. Anguilla’s currency is the East Caribbean (EC) dollar, used by eight of the nine ECCB jurisdictions. There is little evidence the common use of the EC dollar significantly raises the risk for money laundering.

Anguilla financial legislation strictly protects the privacy of offshore bank accounts and business entities. The Offshore Banking Act of 2005 prohibits all bank employees or agents from disclosing any financial information without the express consent of the account holders. There are no exchange controls regarding monetary or asset transfers.

Anti-Money Laundering: FATF Status

Anguilla is not on the FATF List of Countries that have been identified as having strategic AML deficiencies. Anguilla is a member of the Carribbean Financial Action Task Force (CFATF).

Member of Caribbean Financial Action Task Force (CFATF)

In November 1996, 21 members of the CFATF entered into a Memorandum of Understanding which now serves as the basis for the goals and the work of the CFATF. In this document, CFATF members agree to adopt and implement the 1988 UN Convention Against Illicit Traffic in Narcotic Drugs and Psychotropic Substances; endorse and implement the FATF Forty Recommendations and the CFATF Nineteen Recommendations; fulfill the obligations expressed in the Kingston Declaration as well as, where applicable, in the Plan of Action of the Summit of the Americas; and to adopt and implement any other measures for the prevention and control of the laundering of the proceeds of all serious crimes as defined by the laws of each Member.

Corporate Entities

International Business Company (Company limited by shares) Anguilla is an offshore incorporation centre and tax neutral jurisdiction that enjoys high reputation and stability as a British Overseas Territory. As other British Overseas Territories, Anguilla has well-regulated corporate and financial services industry.

Taxation

Anguilla has become a respected tax haven. The offshore jurisdiction of Anguilla levies zero-taxation on all income generated outside of the jurisdiction by offshore companies. Anguilla is a pure tax haven that does not impose income taxes, estate taxes, stamp duty or capital gains taxes on individuals or corporations.

Registration of Offshore Companies

The Anguilla Offshore Company is based on the traditional International Business Companies (IBC) model. Chinese names are permitted and can be included on a company’s Certificate of Incorporation. Companies incorporated in any other jurisdiction may be continued in Anguilla as an Anguilla Offshore Company. An Anguilla Offshore Company can, where the laws of another jurisdiction permit, redomicile to such jurisdiction.

One of the more commended features about Anguilla’s company registration system is Anguilla Commercial On-line Registration Network (ACORN), which went live in 1998. It is able to facilitate the incorporation of companies such as International Business Companies (IBCs) and Limited Liability Companies (LLCs) 24 hours a day, 365 days a year, from anywhere in the world via the internet through licenced company managers and trust companies together with approved overseas agent.

TERMS AND CONDITIONS:

|

24/7/365

24/7/365