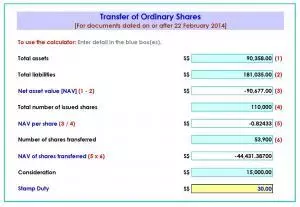

The contract should make the sale price clear. The sale price may not be so easy to calculate if, for example, the amount payable is to be adjusted according to the future profits of the company. However, the price payable may be fixed beforehand. This is common where there is a shareholder agreement with ”drag-along” or “tag-along” clauses.

When the shareholder agreement contains a drag-along clause, then if the majority shareholder(s) are selling their shares to a third-party, minority shareholder(s) are compelled to sell their shares at the same price too.

Whereas if the shareholder agreement contains a tag-along clause, then the minority shareholder(s) can compel the majority shareholder(s) to require the buyer to buy their shares at the same price too.

As a director, knowing the basis for the transfer is good practice to help prevent fraudulent transfers.

Company-Level restrictions on transferring shares

Advising shareholders on restrictions on transferring shares (if any)

When approached by a shareholder who intends to transfer their shares, the board should first advise the shareholder if there are any restrictions on the share transfer which usually the Company Secretary will check it.

The company constitution usually provides that share transfers can only take place with board approval. Although the step of obtaining board approval usually only has to be settled when the transferor presents a Share Transfer Form to the board, it may be a good practice for shareholders to discuss their intentions to transfer their shares with the board early, so the directors and the other board members can give some sort of indication of where it stands beforehand.

Approval of share transfer by the board

If share transfers can only take place with board approval, the board should then consider whether approving the transfer would be in the company’s interests.

Denial of Share Transfer

The board who may be majority shareholders in the company feels that it will not be able to work with the proposed new shareholder effectively. This might apply especially in smaller companies where shareholders have a close relationship with company management.

The board has genuine concerns about whether the proposed new shareholder would act in a way that supports the company’s aims and values. This might be especially true in companies with a smaller number of shareholders, and where it is expected that a significant level of shareholder input is needed for various management decisions.

However, it would likely be inappropriate to deny a transfer request in the form of punishment to a transferor for showing no loyalty.

Recording of decision for Share Transfer

When deciding whether to approve the share transfer, the board should record its decision and the reason for its decision in a properly-minuted board resolution. The board’s decision with valid justified reasons for it should then be promptly communicated to the transferor.

Importance of prioritising pre-emption rights before selling shares

If the Constitution of the Company is specified with pre-emption rights then It is also possible that, before offering their shares for sale to outsiders, the transferor must first offer their shares to all existing shareholders proportionately. The Company Secretary will be able to check it by going through the Constitution.

If the other shareholders have pre-emption rights, they will need to be sent a Notice of Transfer of Shares to indicate if they want to exercise their pre-emption rights. In case, none of the existing members wish to exercise their pre-emption rights, they should all sign a Consent for Waiver of Pre-emption Rights.

It will make it less likely that the transfer will be subsequently challenged or found to be invalid by following this procedure and obtaining the relevant consents from the existing members in accordance with the Constitution of the Company.

24/7/365

24/7/365