Businesses Required to Register for GST

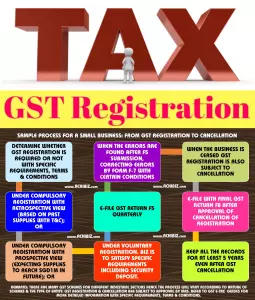

As a business, you must register for GST when your taxable turnover exceeds $1million.

If your business does not exceed $1 million in taxable turnover, you may still choose to voluntarily register for GST after careful consideration.

Please refer to IRAS webpage at www.iras.gov.sg for more information on whether you need to register for GST.Charging and Collecting GST

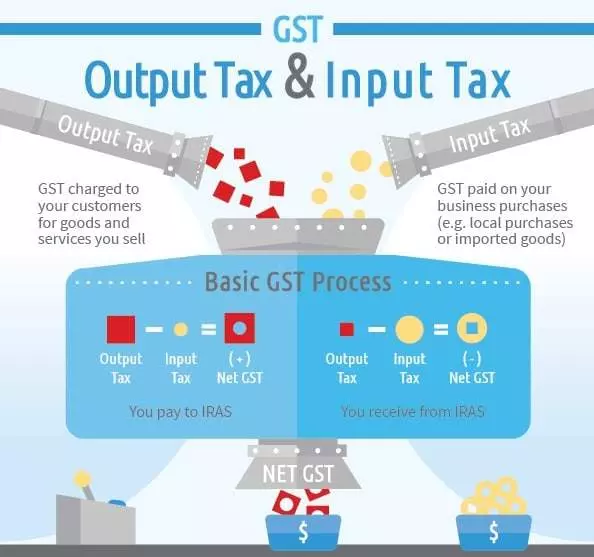

Once you have registered for GST, you must charge GST on your supplies at the prevailing rate with the exception of relevant supplies that are subject to customer accounting. This GST that is charged and collected is known as output tax. Output tax must be paid to IRAS.

The GST that you incur on business purchases and expenses (including import of goods) is known as input tax. If your business satisfies the conditions for claiming input tax, you can claim the input tax on your business purchases and expenses.

This input tax credit mechanism ensures that only the value added is taxed at each stage of a supply chain.

24/7/365

24/7/365