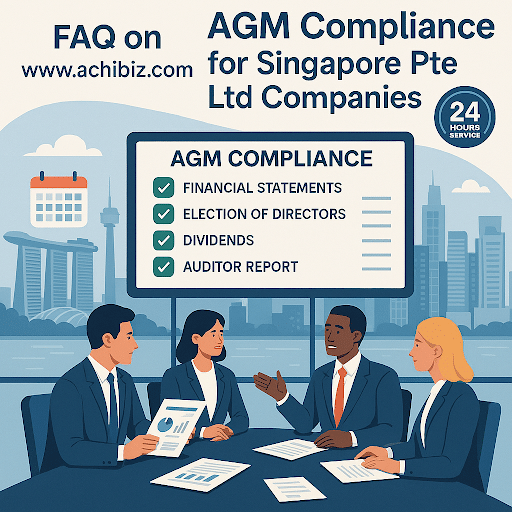

AGM Compliance Overview

Every Singapore-incorporated Private Limited company must comply with the Companies Act regarding AGMs, unless it has formally dispensed with AGMs by shareholder resolution.

AGMs ensure shareholders are informed and involved in key decisions, maintaining transparency and accountability.

1. Legal Requirements

Annual General Meetings (AGMs)

AGMs are mandatory for Singapore Private Limited companies

unless formally waived by shareholders.

Transparency and Accountability

AGMs promote transparency by informing shareholders and

ensuring accountability in company decisions.

Corporate Governance Importance

Compliance with AGMs highlights the role of governance in

protecting shareholder interests and organizational integrity.

Regulatory Compliance

Non-compliance with AGM legal requirements risks penalties and

regulatory scrutiny.

2. Timing and Deadlines

First AGM: Must be held within 18 months of incorporation.

Subsequent AGMs: Must be held within 6 months after the financial year end (FYE).

Annual Return: Must be filed with ACRA within 7 months after FYE.

Initial AGM Timing

The first AGM must be held within 18 months of incorporation to

allow financial statement preparation.

Subsequent AGM Schedule

Subsequent AGMs take place within six months after the financial

year end for timely shareholder review.

Annual Return Filing

Annual Returns must be filed with ACRA within seven months after

FYE to maintain compliance.

Compliance Monitoring

Robust internal processes help companies track deadlines and avoid

penalties effectively.

3. Dispensation of AGM

3. Dispensation of AGM

Companies may choose to dispense with AGMs if all shareholders agree. In this case, resolutions are passed by written means, but financial statements must still be sent to shareholders within 5 months after FYE.

Unanimous Shareholder Agreement

AGMs can be dispensed if all shareholders agree unanimously,

allowing resolutions via written communication.

Financial Statement Requirements

Companies must send financial statements to shareholders within

five months after the financial year end.

Compliance and Regulations

All statutory financial disclosures and shareholder communications

must be maintained to avoid regulatory issues.

Flexibility for Companies

Dispensing with AGMs offers flexibility for companies with fewer

shareholders or streamlined administration.

4. Preparation and Documentation

- Prepare audited financial statements (unless exempt).

- Send notice of AGM to shareholders at least 14 days in advance.

- Prepare proxy forms for shareholders unable to attend.

- Keep minutes of the meeting and update statutory registers.

Audited Financial Statements

Companies must prepare audited financial statements unless legally

exempt to ensure financial transparency.

Advance AGM Notice

Notices must be sent to shareholders at least 14 days prior to allow

sufficient review time.

Proxy Forms Preparation

Proxy forms ensure shareholders unable to attend can still exercise

voting rights effectively.

Meeting Minutes and Registers

Recording minutes and updating statutory registers maintains

accurate records of company governance.

5. Conducting the AGM

- AGMs can be held physically or virtually (e.g., via video conferencing), provided all participants can communicate and vote.

- Quorum requirements must be met as per the company’s constitution.

Physical and Virtual Formats

AGMs can be held physically or virtually using video conferencing to

ensure effective communication among participants.

Quorum Requirements

Meeting quorum as per the company constitution is essential for the

AGM to be valid and decisions to be recognized.

Shareholder Rights and Compliance

AGMs must uphold shareholder rights and comply with legal and

statutory requirements regardless of meeting format.

Virtual AGM Benefits

Virtual AGMs offer convenience and accessibility, allowing

participation from multiple locations easily.

6. Key Agenda Items

6. Key Agenda Items

- Adoption of financial statements.

- Appointment/re-appointment of directors and auditors.

- Declaration of dividends.

- Approval of directors’ fees.

- Any other business as required.

Financial Statements Adoption

Shareholders review and adopt the company’s financial statements

to ensure transparency and accountability.

Director and Auditor Appointments

Appointment or re-appointment of directors and auditors is

conducted to maintain governance and oversight.

Dividend Declaration

Declaration of dividends provides shareholders with returns on their

investments as approved in the meeting.

Approval of Directors’ Fees

Shareholders approve directors’ fees to ensure fair compensation

aligned with company performance.

7. Compliance Risks

Failure to hold AGMs or file annual returns on time can result in penalties,

fines, or prosecution by ACRA.

Directors may be debarred from acting as directors of other companies.

Legal Consequences

Non-compliance can lead to penalties, fines, and

prosecution by regulatory authorities like ACRA.

Director Debarment

Directors failing compliance risk being barred from

erving in other companies.

Importance of Compliance

Adhering to statutory requirements helps avoid

reputational damage and ensures operational

stability.

8. Best Practices

- Maintain accurate records and minutes.

- Ensure timely preparation and distribution of documents.

- Use professional secretarial services for guidance and compliance support.

Accurate Records and Minutes

Maintaining precise records and meeting minutes ensures

transparency and supports compliance during AGMs.

Timely Document Preparation

Preparing and distributing AGM documents on time facilitates

smooth meetings and regulatory adherence.

Engaging Professional Services

Professional secretarial services provide expert guidance to reduce

risks and manage compliance efficiently.

9. Useful Resources &Assistance

- https://new.achibiz.com/guides/business-guide/guide-types-of-firms-entities/singapore-companies/private-co-ltd-by-shares/

- https://new.achibiz.com/guides/business-guide/corporate-secretarial-services/

Tip: ACHI Biz Services Pte Ltd can assist with AGM preparation, statutory filings, and ongoing compliance to help you avoid penalties and stay on track.

24/7/365

24/7/365