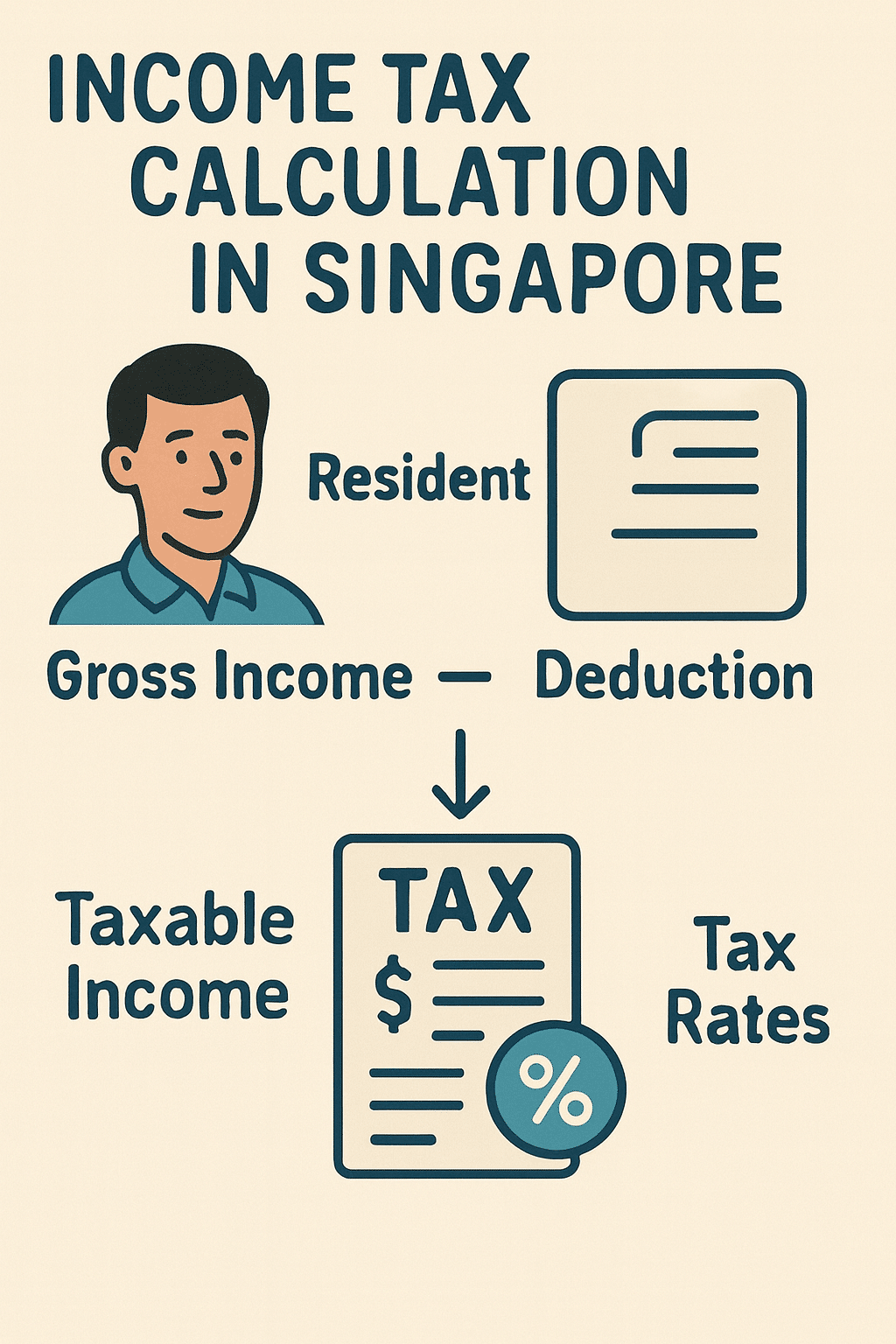

Whether you’re a resident or an expatriate in Singapore, understanding your finances is crucial. From deciphering how much you earn after taxes to calculating your chargeable income, having the right tools can make a significant difference. Singapore’s financial landscape can be complex, with various tax rates and reliefs applicable to different income brackets.

In this article, prepared by Achi Biz, we’ll delve into some of the best Singapore Calculator tools available to help you manage your finances with ease and precision, ensuring you’re well-equipped to handle your financial obligations.

Why Calculate Annual Income After Taxes?

Why Calculate Annual Income After Taxes?

Knowing your annual income after taxes is not just about satisfying curiosity. It helps you plan your expenses, savings, and investments accurately. When you know exactly how much you take home, you can set realistic budgets and financial goals. It’s also crucial when applying for loans or mortgages, as lenders often want to know your net income to assess your ability to repay. Additionally, a clear understanding of your net income can help you identify opportunities for tax-saving strategies, such as investment-linked insurance or contributions to the Supplementary Retirement Scheme (SRS).

Best Tools for Calculating Annual Income After Taxes

Several online calculators can help you determine your net income in Singapore. These tools typically require you to input your gross salary and any additional sources of income. They then deduct the applicable taxes based on Singapore’s tax rates to give you a clear understanding of your take-home pay. Each of these tools offers unique features that cater to different user needs, from simple calculations to more comprehensive financial planning.

- IRAS Tax Calculator – The Inland Revenue Authority of Singapore (IRAS) provides an official tax calculator that is accurate and reliable for computing your taxes and net income. It is updated regularly to reflect any changes in tax legislation, ensuring your calculations are precise.

- Salary.sg Income Tax Calculator – This user-friendly tool allows you to input various forms of income, providing a comprehensive view of your annual income after taxes. It also offers a detailed breakdown of your tax obligations, making it easier to understand how your income is taxed.

- SingSaver Tax Calculator – Known for its detailed breakdown, this calculator helps in understanding how different components of your income are taxed. It also offers insights into potential tax reliefs you might be eligible for, helping you maximize your net income.

How to Calculate Chargeable Income in Singapore

How to Calculate Chargeable Income in Singapore

Chargeable income is another critical aspect of personal finance in Singapore. It is the amount of income subject to income tax after deducting personal reliefs and allowable business expenses. Understanding how to calculate your chargeable income is vital for accurate tax filing and avoiding any legal issues with underreporting. Furthermore, knowing your chargeable income helps you optimize your tax liabilities, ensuring you only pay what is necessary.

Steps to Calculate Chargeable Income

- Determine Your Total Income – Start with your total income, which includes your salary, bonuses, and any other income sources. Be sure to account for all possible income streams, such as rental income or dividends, to ensure comprehensive calculations.

- Subtract Allowable Deductions – Deduct any eligible expenses, such as employment expenses, business expenses, or rental expenses. These deductions can significantly reduce your taxable income, offering potential savings.

- Apply Personal Reliefs – Use applicable personal reliefs, like the parenthood tax rebate or earned income relief, to reduce your taxable income further. Take advantage of all available reliefs to minimize your tax burden.

- Arrive at Chargeable Income – The result is your chargeable income, which is used to determine the amount of tax payable. This figure is crucial for your annual tax return and helps you budget for any tax payments due.

Recommended Tools for Calculating Chargeable Income

- KPMG Personal Tax Calculator – This tool provides a detailed calculation of chargeable income, taking into account all possible deductions and reliefs. It is particularly useful for expatriates who may have complex financial situations.

- EY Tax Calculator – Known for its accuracy, this calculator offers a comprehensive breakdown of your chargeable income. It provides a user-friendly interface that makes it easy to input various income sources and deductions.

- Deloitte Singapore Tax Calculator – Offers a user-friendly interface with detailed input options to ensure precise chargeable income calculations. It is ideal for both individuals and businesses looking to ensure compliance with tax regulations.

Comprehensive Singapore Calculator Tools

For those seeking a more holistic view of their finances, some calculators provide a combination of tax calculations, budgeting, and financial planning. These tools are invaluable for individuals who want to manage their finances comprehensively and strategically.

- HSBC Financial Planning Calculator – This tool not only calculates taxes but also assists with budgeting and long-term financial planning.

- DBS NAV Planner – Provides insights into your overall financial health, helping you track expenses, plan savings, and understand tax obligations.

- OCBC Money Insights – Offers a wide range of financial tools, including tax calculators, to help manage personal finances effectively.

The Importance of Accurate Calculations

Accurate financial calculations are essential for effective budgeting, saving, and investing. They help in making informed decisions about spending, loans, and investments. Inaccurate calculations can lead to financial mismanagement, resulting in unnecessary debt or missed investment opportunities.

Benefits of Using Online Calculators

- Convenience – Access calculations anytime and anywhere.

- Accuracy – Online tools are regularly updated to reflect current tax laws and rates.

- Time-Saving – Quickly compute complex calculations without manual effort.

- Comprehensive – Many tools offer detailed breakdowns and additional features for a holistic financial view.

Conclusion

Navigating the financial landscape in Singapore doesn’t have to be daunting. With the right Singapore Calculator tools, understanding your annual income after taxes and calculating your chargeable income becomes a straightforward task.

At Achi Biz, we help businesses and individuals manage financial records with confidence. Whether you’re planning your taxes, budgeting, or exploring new strategies, having the right tools ensures accuracy, compliance, and peace of mind.

24/7/365

24/7/365